In 1998, Democrats and Republicans worked together to balance the Federal budget. The total US National Debt was $5.5T, accumulated over the first 222 years since the founding of the republic. In the last 24 years, we’ve added $28T more to bring the total National Debt above $34T. We’ve been blowing through “Debt Ceilings,” having political fights about whether we should shut down the government, then kicking the can down the road and acting like it never happened. It’s time we stop ignoring the elephant in the room and proactively address the problem before it is too late.

Why Should We Care?

The National Debt may just seem like a big number that has no impact on our lives. However, as that number grows, so does the interest we need to pay each year. The interest on the US national debt is now so large that it takes over 30% of our personal income taxes each year to pay the interest expense. As interest rates go up and Treasury bonds need to be reissued, this will get worse. If we continue to run huge deficits each year and rapidly accumulate more debt, we will dig a hole where the majority of the income tax we pay goes to interest payments instead of the infrastructure and services we need.

A Moral Obligation

We are relying on the credit of the US Government to fund our lifestyle without paying for it, passing the costs on to future generations. The deeper we dig this hole, the more painful it will be to resolve. If we do nothing, we are setting our children up for severe financial hardship. We risk creating an environment of hyper-inflation that would dwarf what we’ve seen over the last couple years. Is that the legacy we want to create?

Putting Ourselves At Risk

During financially stable times, we need to build up a financial cushion so that when we get to the next financial downturn or global crisis, we have room to borrow and fund our way out of the problem. A large amount of our debt was accumulated through the “War on Terror,” the “Great Recession of 2008,” and the COVID pandemic. But now that those have passed, we still have an annual budget deficit over $1.6T. At this rate, the risk of severe financial pain won’t wait for our children…we are setting ourselves up for failure. According to a Penn Wharton study, if we stay on our current path we have less than 20 years before reaching a point of no return…where default or hyper-inflation is certain.

Shifting the Political Incentives

The thought of Republicans and Democrats in congress working together to balance the budget seems hard to imagine in the current political climate. They do what is politically popular with their voters and donors, which has generally been increasing services and reducing taxes, leading to the huge deficit we have. Politicians in congress will only work together to fix the budget if we demand that they do so. If more people recognize the problem, call for our leaders to come together to address the problem, and support those that do so, there is a possibility for success.

We Need Action, Not Anxiety

I’m not sharing this to make anyone anxious about the problem that is being created, but instead to spur action. Like many things, ignoring this problem only makes it worse, and the best way to prevent anxiety is to face our challenge head on. There are things we can do now to get our finances on track, without creating a huge amount of financial pain. We are not powerless…we control our own destiny.

So How Can We Fix our Budget Problem?

The good news is that stabilizing our financial trajectory does not require us to pay down the existing debt much if any…but we must stop the runaway train of adding more debt. Our goal should be to balance the annual budget. At a bare minimum, we need to make sure that the growth of the debt is slower than the growth of the economy (GDP.) If we do that, then over the long term we can grow our way out of the problem.

Not a Partisan Issue

We are all in this together. The time for partisan bickering and using this issue for political blame or benefit is over. Our financial success as a nation depends on resolving this issue, and we must pull together and collaborate to reach a solution.

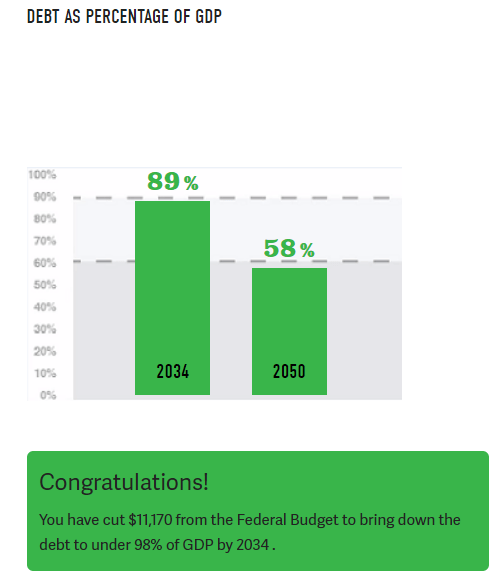

Debt Fixer

The nonpartisan Committee for a Responsible Federal Budget has a great tool that allows you to try to stabilize our national debt. It gives options for changing government income and spending, with a goal of getting the debt to GDP ratio under 90% by 2034 and under 60% by 2050. Try it out and post your results or ideas in a comment!

Recommendations

So how do we get the debt under control without causing a lot of financial pain or risking a recession? We need to increase economic output growth, limit spending growth, identify efficiencies in government programs, and find the least painful ways to increase revenue. I’ll talk about each of these in more detail, and give my concrete options from the Debt Fixer tool.

First and foremost, we need to grow the economy. Productivity gains have been down (surprisingly with the increased role of technology) in recent years, but we are seeing a significant increase in the last several months. Increasing our economic output is a relatively painless way to get our GDP to grow faster than our debt. We should leverage technology and look for efficiencies to grow GDP at a faster rate. As our population ages and birth rates decline, we need to effectively use immigration policy to spur growth as I outline in another post.

We must limit our spending growth, looking for ways to more efficiently deliver the services we currently rely on. Our biggest budget items are Social Security, Medicare, and Medicaid. While the Affordable Care Act may have slowed down the growth rate of health care costs, it did not really make health care affordable…I think there are still a lot of inefficiencies in the system that could be addressed. The USA spends the most on health care by far, and our measured outcomes are not substantially better than other countries. I’ll tackle that one in a future post. We must also limit our spending growth in Defense and Discretionary categories.

We need more revenue. The key is how we get that revenue in the least painful way possible, minimizing risk to economic growth. I know everyone hates taxes, and the idea of any tax increase is unpopular, but the pain of impending hyper-inflation in the not-so-distant future would be much worse than targeted tax increases that enable us to balance our budget.

Some Concrete Options

It’s a lot easier to generally agree that we need to do these things than it is to agree on the specific details. This is the difficult work that our leaders need to do together. Here was my first shot at using the Debt Fixer tool to meet the debt stabilization goals. Impact to the debt over the next 10 years is shown, relative to the current plan.

- Limit Defense spending growth to 1% – $510B

- Limit Discretionary Spending Growth to 1% – $410B

- Ultra-Milionaire Wealth Tax – $3.08T (2% on worth above $50M, 3% on worth above $1B)

- Social Security:

- Subject Earnings over $250,000 to the payroll Tax – $1.39T

- Means-Test Benefits for High-Earning Seniors – $240B

- Medicare/Medicaid Efficiencies – $2.35T

- Close corporate tax loopholes including foreign-earned income and undertaxed profits – $830B

- Use Carbon Tax instead of Carbon Credits – $910B – $710B = – $1.62T

- Repeal 2017 Tax Cuts – $520B

- Increase Legal Immigration – $220B

- Tax Capital Gains the same as Income – $340B

- Close payroll tax loophole for self employed – $320B

- Reduce the cost of the federal & defense workforce – $280B

This wouldn’t get rid of our national debt, but it would get our debt back to a sustainable percent of GDP. I’d love to hear comments about these proposals…while this is the hardest part, it’s also the most interesting.

Additional Information

- Committee for a Responsible Federal Budget (crfb.org)

- Podcast: National Debt – 5 Things You Need to Know (moneyfortherestofus.com)

- Peterson Foundation – Options to reduce the federal deficit

- Congressional Budget Office – Options for Reducing the Deficit

- Penn Wharton study – When is the point of no return?

- McKinsey – Rekindling US productivity for a new era

- US Deficit by Year (thebalancemoney.com)

- Podcast: The Problem With a $2 Trillion Deficit (The Daily)

Image Credits

Leave a comment